Quickly Manage Risk and Make Confident Decisions

Obtain Fast Results

24-48 hour turn time for a clear, thorough appraisal review, resulting in an increase in loan closing rates.

Effectively Manage Risk

Easily identifies red flags or actionable discrepancies. Identify appraisals needing further review or escalation.

Enable Informed Decisions

Detailed appraisal analysis helps to create a clear, detailed report summary to support smarter lending and investment decisions.

Common Uses for ValREVIEW

Forensic Due Diligence

Take the first step to decide if an appraisal warrants a more extensive review.

Pre-Fund Due Diligence

Utilize data from the report to support pre-fund due diligence before funding the loan.

Examine Comparables

Obtain more comparables to validate the ones used to represent the property and market.

Reinforce Client Confidence

Confirm the appraisal was conducted correctly while utilizing data to boost clients’ confidence.

Quality Assurance

Conduct an internal quality assurance audit in post-fund due diligence for lenders and investors.

GSE Post-Board Resource

Assess the reliability of the valuation to understand if a repurchase is justified.

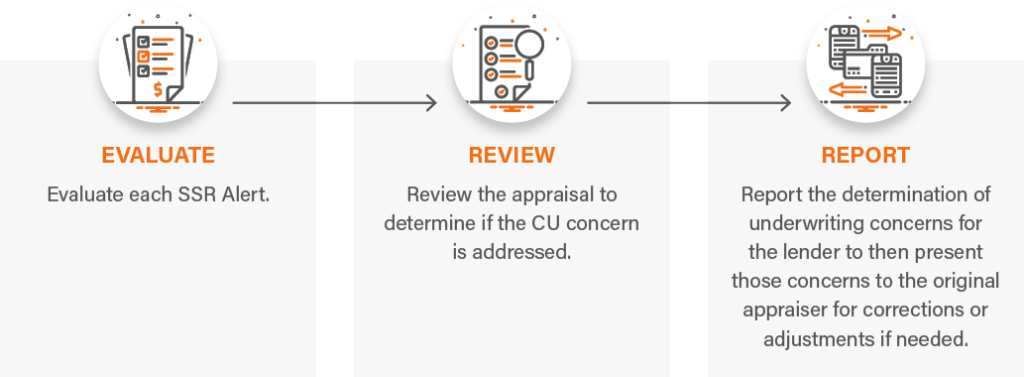

Thorough, Detailed, Actionable Review

GSE SSR flags are reviewed and individually addressed indicating whether it was adequately represented in the appraisal. The underwriter conducts a systematic approach to derive an overall appraisal quality score, determine various risk factors and comment on the adequacy of each section of the appraisal report.

Valuable Appraisal Review Features

- 160+ point appraisal review

- Appraisal quality score (AQS)

- Extensive analysis & commentary

- Underwriting concerns clearly specified

- Extensive market/foreclosure/risk analytics

- Verification of all appraisal data

- Verification that the appraiser’s license is in good standing

- Several MLS closed sales and active listings

- Upgrade to USPAP compliant appraisal review when appropriate

- Regulatory comp

Interested in Learning More?

Speak With Our Team

877-490-0390