eVAL is an Interagency Appraisal and Evaluation Guidelines (IAEG) compliant property evaluation. It is based on extensive market and value analysis resulting in a well-supported, accurate value of the subject property.

Fast, Accurate and Low-Cost Solution

Timely

Turn times as short as 4-hours with a virtual property inspection, 2 – 3 days with a drive-by inspection.

Accurate

High accuracy and impeccable quality control results in 1-2% revision rates.

Cost Efficient

Cost efficient process provides a lower cost valuation than a traditional appraisal.

Versatile and Widely Used

eVAL is available with the option of an interior, exterior or virtual property inspection. Coverage is nationwide.

Origination

Commonly used in home equity and second mortgage lending.

Default Servicing

Determine which loans should be monitored and/or sold to minimize financial risk and mitigate losses.

Portfolio Management

Track where homes are appreciating and depreciating with information in the market.

Investing

Quickly identify high-risk properties in a pool of loans, make decisions ahead of your bid, and quickly identify collateral risk.

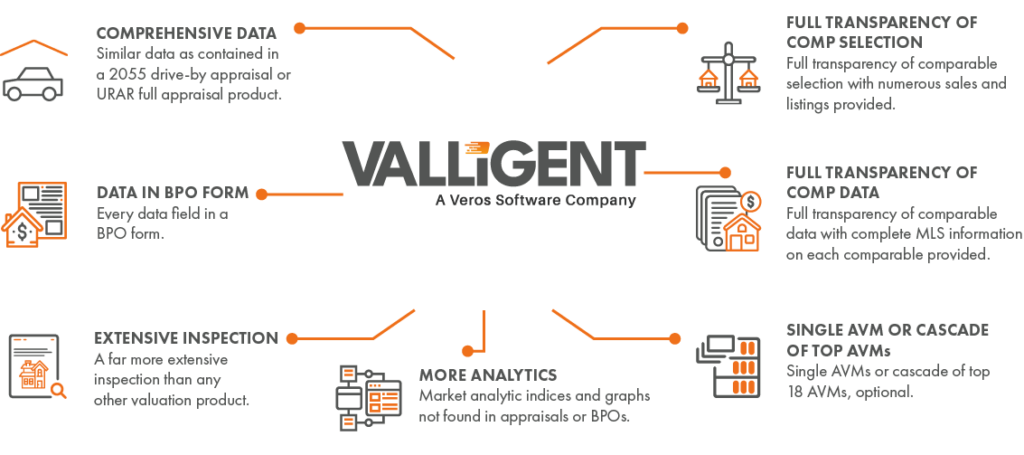

Data and Visually Rich Report

eVAL reports are completed by an experienced analyst, then reviewed by a valuation expert.

- Property details with photos

- Market statistics

- Comparable sales with photos and listings

- Subject neighborhood, site, improvements, and market condition comments

- Price and listing history

- Transaction history

- Zip code data

- Comparable comments and final reconciliation

Interested in Learning More?

Speak With Our Team

877-490-0390